-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

Amana Capital Broker Review

Last Updated On May 9, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on Amana Capital

For experienced traders who value a broad range of tradable assets and an extensive suite of trading tools, Amana Capital is a tempting option, though trading costs are higher than other brokers on its entry-level account.

Amana Capital’s entry-level commission-free account has relatively wide spreads, but it also offers two high deposit (>25,000 USD) account options- Amana Active and Amana Elite – with tight spreads (0.1 pips on the EUR/USD) and a small commission per lot traded. Experienced traders may also be attracted by the number of tradable assets on offer, including over 332 share CFDs and 66 Forex pairs alongside indices, commodities, metals, energies, and cryptocurrencies.

Amana Capital supports both the MT4 and MT5 trading platforms, and traders have access to some of the best trading tools in the industry, including Autochartist, Trade Captain, Zulutrade, and a VPS hosting service. All tools are offered free of charge to those with a live account, but the VPS service is exclusively for Amana Active clients.

Beginners will find Amana Capital’s education section comprehensive and detailed, but it offers virtually no market analysis. Other disadvantages are a largely unresponsive customer support service, and substantial fees for deposits and withdrawals.

| 🏦 Min. Deposit | USD 50 |

| 🛡️ Regulated By | CySEC, FCA, DFSA, CMA |

| 💵 Trading Cost | USD 14 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Energies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Tight spreads

- Great customer support

Cons

- High minimum deposit

- Limited market analysis

Is Amana Capital Safe?

Yes, Amana Capital is considered a safe broker to trade with. It maintains regulation from some of the world’s top regulators, including the UK’s FCA, the DFSA in Dubai, CySEC in Cyprus, the CMA from Lebanon, the LFSA of Malaysia, and the FSC of Mauritius.

Founded in 2010 and headquartered in London, Amana Capital is authorised and regulated by the Financial Conduct Authority (FCA) the UK, the Dubai Financial Services Authority (DFSA), the Cyprus Securities and Exchange Commission (CySEC), the Lebanese Capital Markets Authority (CMA), the Labuan Financial Services Authority (LFSA), and the Financial Services Commission (FSC) Mauritius. See below for more information on the regulation of its subsidiaries:

- Amana Financial Services UK Ltd, licensed by the Financial Conduct Authority (FCA), (License Number 605070)

- Amana Financial Services Dubai Ltd, licensed by the Dubai Financial Services Authority (DFSA) (Registration Number F003269)

- Amana Capital Ltd, licensed by the Cyprus Securities and Exchange Commission (CySec) (License Number 155/11)

- Amana Capital SAL is authorised and regulated by the Lebanese Capital Markets Authority (CMA), License Number 26.

- AFS Global is regulated and authorised by LFSA – Malaysia, Registration Number MB/18/0025.

- ACG International is regulated and authorized by the Financial Services Commission – Mauritius (FSC) – Registration number C118023192.

Australians will be trading under the subsidiary, ACG International, regulated and authorised by the Financial Services Commission Mauritius (FSC). The FSC’s rules are not as strict as those of the FCA or CySEC, but it does allow Amana Capital to provide its clients with higher leverage.

In accordance with FSC regulation, Amana Capital holds all client funds in segregated accounts and provides negative balance protection, which means that clients can never lose more than is in their trading accounts. Amana Capital’s clients with accounts under the FSC licence will also benefit from 1,000,000 USD protection insurance should the Company be liquidated.

Amana Capital has not won any recent awards, but based on its broad regulatory oversight, we deem it a reliable and secure broker.

Trading Fees

Amana Capital’s trading fees are higher than other similar brokers.

Unlike other brokers that offer a range of CFD trading accounts with higher minimum deposits linked to tighter spreads, Amana Capital offers a single live commission-free account available on two different platforms (click here for more on Amana Capital’s trading platforms).

Amana Capital also offers an Active Trader Programme, an Elite Account, and a Share Account. However, for the purposes of this review, we will focus on the trading conditions of the CFD accounts (click here for more on Amana Capital’s trading accounts).

Amana Capital’s accounts were assessed to compare the costs to those of other forex brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads and commission.

When making this calculation, we used one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table above, Amana Capital offers one commission-free account with trading costs included in its variable spreads. This means that the spread will fluctuate and get wider or tighter depending on trading volume and market volatility. Overall, at 14 USD per lot traded, Amana Capital’s trading costs are higher than the industry average. The trading costs on the EUR/USD at other good brokers tend to be around 9 USD per lot traded.

However, Amana Capital also offers two high deposit accounts that are suitable for more experienced traders – the Amana Active Account and the Elite Account. The Amana Active Account requires a minimum deposit of 25,000 USD and spreads tighten to 0.1 pips on the EUR/USD in exchange for a commission of 3 USD per lot traded, which is highly competitive. Trading costs improve further on the Elite Account, but this requires a minimum deposit of 250,000 USD.

Swap Fees

Another important cost to consider is the swap rate charged on positions held overnight. Interest is paid (or received) for each night a position is held. When trading a currency, you are borrowing one currency to purchase another. The swap interest fee is calculated based on the difference between the two interest rates of the traded currencies.

The swap fee is credited or debited once for each day of the week, at midnight server time, when a position is rolled over, with the exception of Wednesday for spot Forex, WTI, & Brent oil, when it is credited or debited 3 times.

The following calculation can be used:

Swap = (Number of lots x Pip value x Swap rate x number of nights) / 10

By way of example:

A client was 2 lots short position on the EUR/USD and held the position for one night:

- 1 lot = 100,000 euros

- Pip value = $10

- Number of lots = 2 lots

- Swap rate= -8.5 Long & +7 Short

- Holding period = 1 night

Swap = (Number of lots x Pip value x Swap rate x number of nights) / 10

Swap = (2 x 10 USD x 7 x 1)/10 = 14 USD

Clients will be charged 14 USD for holding a short position of EUR/USD overnight.

Non-trading Fees

Amana Capital’s non-trading fees are higher than other similar brokers.

Amana Capital does not charge account or inactivity fees, however, it charges relatively high deposit and withdrawal fees.

For example, using Neteller a fee of 3.9% + 0.29 USD is charged for making deposits, and for withdrawing funds, a fee of 2%, capped at 30 USD is charged (click here for more on Amana Capital’s deposits and withdrawals).

Opening an Account at Amana Capital

The account opening process at Amana Capital is user-friendly, fully digital and accounts are ready for trading immediately.

All Australian residents are eligible to open an account at Amana Capital but have to meet the minimum deposit requirement of 50 USD.

Creating an account is straightforward, the process is fully digital, and accounts are usually ready immediately. Amana Capital offers individual, joint, and corporate accounts, but we will focus on opening an individual account:

- New traders will have to click on the “Open Real Account” button at the bottom of the page where they will be directed to fill in their personal details, including name, surname, telephone number, and country of residence.

- Next, traders will have to choose their preferred platform, base currency, nationality, and employment type.

- Once this step is complete, clients are required to fill out a questionnaire that helps Amana Capital assess the trader’s investment knowledge, experience, and expertise to deem the suitability and relevance of the services on offer. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- Amana Capital requires at least two documents to accept you as an individual client:

- Proof of Identification – Amana Capital accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the Amana Capital’s account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

After the application is approved, traders can login and fund their accounts.

Overall, Amana Capital’s account-opening process is fully digital and hassle-free and accounts are generally ready for trading once all documentation has been approved.

Amana Capital’s Trading Account

Amana Capital offers a single trading account, which is suitable for beginner traders, but it also offers an Active Trader Programme and Elite Account for more experienced traders.

A market maker, Amana Capital offers trading on multiple assets, including Forex, energies, cryptocurrencies, indices, commodities, metals, and shares. Amana offers a single live commission-free account for Forex and CFD trading. However, with higher minimum deposits, traders get access to the Active Trader Programme or can choose to become professional traders. Amana Capital also offers a Shares Account, which will not be the focus of this review.

Amana Capital offers support for the MT4 and MT5 trading platforms, in addition to Zulutrade, and allows all trading strategies, including hedging, scalping, and copy trading. Amana Capital also offers Islamic swap-free accounts.

Amana Capital’s Classic Account has a minimum deposit requirement of 50 USD, making it accessible to beginner traders.

We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek.

In general, experienced traders tend to prefer accounts with higher minimum deposits and tighter spreads. Amana Capital’s Active Trader Programme would be more suitable for experienced traders, with a minimum deposit requirement of 25,000 USD and a minimum trading volume of 100 million USD per calendar month. Spreads tighten to 0.1 pips on the EUR/USD in exchange for a commission of USD 0 USD per lot, which is more in line with the trading costs experienced traders may be looking for. Experienced traders may also be interested in the Amana Elite Account with even lower spreads and flexible commissions in exchange for a minimum deposit of 250,000 USD.

Traders should note that although Amana Capital states that its accounts are market execution accounts with no requotes, Amana Capital acts as the principal and not an agent on the client’s behalf. This means that Amana Capital is the sole counterparty to the client’s trades and execution of orders is done in the Company’s name. Therefore, Amana Capital is also the sole Execution Venue for the client’s orders, which is why the spreads on Amana Capital’s Classic Account are not as favourable as those of other brokers.

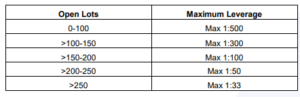

Leverage

Amana Capital uses a dynamic Forex leverage model, which automatically reflects on clients’ trading positions. As the volume for each trading instrument of a client increases, the maximum leverage offered decreases accordingly, as per the table below:

Amana Classic

The commission-free Amana Classic Account has a minimum deposit requirement of 50 USD. Spreads start at 1.40 pips pips on the EUR/USD, which is wider than other market makers. Stop Out levels are at 20%, and accounts are denominated in USD, EUR, or GBP. No commissions are charged on Forex or Cash CFDs, but 10 USD/lot is charged on Futures trading and 0.02 USD/share on share CFDs.

Amana Active

The Amana Active account requires a minimum account balance of 25,000 USD and a minimum volume of 100 million USD per calendar month, but spreads are much tighter (down to 0.1 pips on the EUR/USD). A commission of USD 0 USD/lot traded is charged on Forex and 5 USD/lot on future CFDs. Traders have access to a personal account manager, API Trading, trading signals and technical studies, and a free VPS service.

Amana Elite

The Elite account is Amana Capital’s professional account. With a minimum deposit requirement of 250,000 USD, traders can access the tightest spreads and can negotiate their commissions. Traders also have access to a personal account manager, personal coaching sessions, and elite trading tools.

Swap Free Accounts:

Amana offers Swap-Free accounts for traders who choose not to receive or pay daily swaps in adherence to Islamic religious principles. When trading a Swap Free Account, currency pairs held overnight will not be ‘paid or charged’ a daily swap fee. Swap-Free terms are not applicable on the following:

- FX pairs containing CZK, HKD, NOK, PLN, SEK, SGD, TRY, ZAR, RUB.

- Cash CFDs: U30USD, NASUD, 100GP, E50EUR, D30EUR, F40EUR, SPXUSD.

- Spot Energies: WTIUSD, BRENTUSD.

Fees may be applied on a Swap Free trade in case trading positions are held open for more than 10 (ten) days, unless waived by Amana. Such fees can be applied from the time the position was opened and at the sole discretion of Amana Capital. Please contact customer support for more details.

Demo Account

Amana Capital offers a demo account that allows you to trade instruments without risking real money. It comes loaded with virtual funds and is available for 30 days on the MT4 and MT5 trading platforms.

Deposits and Withdrawals

Amana Capital offers a wide range of payment methods, but it charges high fees for deposits and withdrawals.

In line with Anti-Money Laundering policies, Amana Capital does not accept payments from third parties and only accepts funds received directly from the named trading account holder. Accounts can be funded via Credit Card, Bank transfers & e-wallets. Amana Capital charges a fee for handling deposits dependent on the payment method, and commissions can be as high as 1.5% for withdrawals. Withdrawals take around 3 – 4 days to be processed, which is longer than the industry average. See below for a list of funding methods, charges, and processing times:

Overall, Amana Capital has a good range of funding methods, but withdrawal and deposit fees are higher than other similar brokers. Of particular note are the deposit fees charged for depositing and withdrawing via Neteller and Skrill.

Base Currencies

Amana Capital offers a limited number of base (trading account) currencies compared to other similar brokers.

Trading accounts can only be denominated in three base currencies – EUR, USD, and GBP, which is limited compared to other brokers. Most other brokers denominated accounts in at least five to ten currencies. Additionally, Amana Capital does not offer AUD trading accounts, which is a disadvantage for Australians who will likely have bank accounts denominated in AUD, and who will have to pay currency conversion fees on deposits and withdrawals.

For traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with an AUD account, there will be a small conversion fee for every trade made.

Overall, Amana Capital offers fewer trading account currencies than most other large international brokers and doesn’t offer accounts denominated in AUD.

Trading Platforms

Amana Capital’s trading platform support is average compared to other similar brokers.

Amana supports the MetaTrader Suite of platforms. In addition to the desktop applications, Amana Capital also offers MT4 and MT5 WebTrader, which are the browser-based version of the platforms, along with mobile and tablet versions of both iterations. Multiterminal is also available if you are managing numerous accounts simultaneously.

While MT4 and MT5 are both excellent trading platforms, many other CFD brokers also offer their own web-based platforms, which tend to be easier to use for beginner traders. On the other hand, the benefit of Amana Capital offering third-party platforms such as MT4 and MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker. Additionally, there are thousands of plugins and tools available for the MetaTrader platforms.

Metatrader 4

While not the most beginner-friendly software, MT4 has been the industry-standard platform for trading Forex and CFDs since 2005. Its intuitive interface and user-friendly environment provide essential tools and resources for successful online trading. Features of the MT4 include:

- A built-in library of more than 50 indicators and tools to streamline the analysis process.

- An impressive array of analytical tools, available in nine timeframes for each financial instrument.

- Live price streaming on live accounts and demo accounts 128-bits encryption for secure trading

- Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

- Customisable alerts

- Access to MetaTrader market and MQL4 community

Amana supports the MetaTrader Suite of tools. From MT4 and MT5 on a desktop to the smartphone and tablet apps for those who wish to monitor trades, or act on signals. Multiterminal is also available if you are managing numerous accounts simultaneously.

Metatrader 5

Continuing its predecessor’s reputation, the MT5 platform provides traders with everything they need to trade the financial markets. It incorporates all of the key features of MT4 and an optimised environment for algorithmic trading using Expert Advisors (EAs). Features include:

- 38+ preinstalled technical indicators

- 44 analytical charting tools

- 3 chart types

- 21 timeframes

- Additional pending order types

- Detachable charts

- Trailing stop

- Depth of Market

- An integrated Economic Calendar.

Overall, although Amana Capital only offers the Metatrader suite of platforms, which are not as beginner-friendly as the proprietary platforms offered at other brokers, MT4 and MT5 are considered some of the best third-party platforms in the industry.

Amana Capital Mobile Trading

Amana Capital’s mobile trading platforms are average compared to other similar brokers. It offers mobile versions of MT4 and MT5, but no proprietary mobile trading solutions.

Amana Capital offers support for MT4 and MT5 mobile trading apps for Android and iOS. Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Trading Tools

Amana Capital offers an excellent range of trading tools compared to other similar brokers, including technical analysis tools, a copy trading platform, and VPS hosting.

AutoChartist

Free for all Amana Capital clients, no matter the account balance, Autochartist is a popular third-party trading tool. Autochartist continuously scans markets and automatically recognises trade setups based on support and resistance levels. Once an opportunity has been identified, traders are alerted. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

Autochartist is one of the most valuable tools on the market.

Trade Captain

Free for all Amana Capital clients, Trade Captain is a third-party tool that provides a wide selection of innovative educational information, insightful analytics, and news, daily updates on financial markets and trading opportunities.

VPS

Amana Capital clients can also subscribe to a VPS hosting service provided in-house. The VPS service is only available for Amana Capital Active Traders. VPS services ensure that trades are never disrupted by technological or connectivity issues, such as load-shedding or internet service failure, which is a benefit to algorithmic traders who need to be connected to a server 24/7 to maximise uptime. Other benefits of the VPS service include:

- 24/6 VPS email support

- 24/7 Redundant power to your VPS

- 24/7 Redundant internet connectivity to your VPS

- Low latency connectivity to FP Markets trading servers for precision trading

- Uninterrupted EA trading

Zulutrade

Zulutrade is a powerful auto-execution system that duplicates the trades of other successful traders. Features of Zulutrade include:

- Automated strategy copying without any human intervention

- Direct access from mobile and desktop

- Personal portfolio creation without any fees

- A rich set of tools to customize and protect your trades

- Social features to enrich the ZuluTrade experience

- Complete monitoring of open positions in real-time

- Full control of funds

It is free to all Amana Capital clients and offers a rich set of tools to customize and protect your trades.

Risk Pulse

Risk Pulse is a free analytics tool offered to Amana Capital clients. It is designed to help traders analyse and understand their trading habits. The Risk Pulse dashboard displays information about trading performance, calculated predictions of future results, and solutions to enhance trading performance.

Overall, Amana Capital offers an excellent range of useful trading tools.

Amana Capital’s Financial Instruments

The choice of financial assets offered by Amana Capital is wider than other similar brokers.

Amana Capital’s range of financial instruments for CFD trading (click here for more details on CFD trading), includes Forex, share CFDs, commodities, metals, energies, indices, and cryptocurrencies:

- Forex: Amana Capital has over 66 currency pairs available for trading, a broader range than most other brokers. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/JPY, GBP/JPY, and USD/ZAR), and exotics.

- Share CFDs: Amana Capital offers 322 share CFDs, which is average compared to other large international brokers. The selection available includes some of the major US, UK, and European Exchanges. CFDs on shares are subject to dividends. When a share pays dividends to its shareholders, dividend adjustments will be made to the trading accounts of clients who hold a position on the index at 00:00 GMT+2 time zone (DST applies) on the ex-dividend date.

- Indices: There are 20 indices available for trading at Amana Capital, which is around the average available at other similar brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

- Commodities: Amana Capital offers trading on 7 commodities, which is around the average available at other brokers. Most brokers offer between 5 and 10 commodities. Commodities include softs such as sugar, cocoa, and cotton.

- Energies: Like other brokers, Amana Capital offers trading on five energies, including oil, Brent Crude, and natural gas.

- Metals: Amana Capital offers trading on 6 precious metals, including spot gold and silver, and futures. This is around the average offered at most other brokers.

- Cryptocurrencies: Cryptocurrency CFDs are available on some of the Amana Capital accounts. At the time of writing, there are 4 USD currency pairs available, including Bitcoin, Ethereum, Litecoin, and Ripple. The spreads vary significantly compared to other traditional Fiat currencies. It is not unusual for spreads to be as wide as 75 pips on Bitcoin, but cryptocurrency spreads vary greatly, so if you trade these currencies, watch your margins.

Overall, Amana Capital’s CFD offering is in line with what is offered by other similar international brokers but stands out for the number of Forex pairs on offer.

Amana Capital for Beginners

We were pleasantly surprised by Amana Capital’s approach to beginner traders, with a helpful and well-structured education section and excellent customer service for clients all worldwide. First-party analytical resources are almost non-existent, though.

Educational Material

Amana Capital’s educational section is comprehensive and useful for beginner traders, but it is not as good as the best brokers in this space.

Educational Material is freely available to all visitors at Amana Capital and is divided into six sections:

- Seminars – Amana Capital holds regular free seminars across the Middle East. If you live in the region, check the listings to see if there is one scheduled.

- Webinars – Webinars are also free but require registration, and are held frequently. Subjects vary widely from basic concepts to advanced trading strategies. Most webinars are only available in Arabic.

- Videos – Amana Capital offers a small collection of introductory trading videos, but don’t expect anything too in-depth.

- Ebooks – Amana Capital offers a fairly comprehensive collection of eBooks for those who prefer to read when they learn – the material available is more in-depth and more comprehensive than the video library.

- Forex Trading – A brief section on the basics of Forex for those who don’t have the patience to educate themselves thoroughly.

- CFD Trading – Similar to the section above, this material will introduce you to the concepts and intricacies of CFD trading.

Analytical Material

Amana Capital’s market analysis materials are minimal compare to other similar brokers, but it does offer research through third-party providers, Autochartist and Trade Captain.

Apart from a basic Economic Calendar, there is no real market analysis to speak of. Amana Capital will argue that its clients have free access to AutoChartist and Trade Captain (two powerful third-party analytical tools) and therefore, it does not need to provide further analysis – which is a fair point – but it is always good to have as many information sources as possible.

Customer Support

Amana Capital’s customer support is disappointing compared to other similar brokers.

Amana Capital offers multilingual support available 24/5 via telephone, call back, email, and messenger services such as WhatsApp, Facebook Messenger, Twitter, and Telegram. Support is offered in five languages.

For the purposes of this review, the live chat feature was not working. We also emailed customer support numerous times and got no response. Amana Capital also advertises a call-back service which we tried, but again, there was no response. Overall, it seems that Amana Capital really needs to focus on improving its customer support.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Amana Capital offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Warning

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Amana Capital would like you to know that: Forex and CFDs are leveraged financial instruments that carry a high degree of risk and may expose you to significant losses. Trading in CFDs may not be suitable for all investors. You should ensure before trading you fully understand the risks involved and consider your level of experience. If necessary you should seek independent advice.

Overview

Amana Capital is a trustworthy and dependable broker offering trading on a broad range of tradable assets. With one live commission-free account, spreads are wider than the industry average. However, with higher minimum deposits, more experienced traders can access tighter spreads in exchange for a small commission per lot traded. Trading is offered on both MT4 and MT5, and Amana Capital offers an excellent range of trading tools. Its educational suite is extensive and well-structured, but customer support is largely unresponsive. It also charges high deposit and withdrawal fees on some payment methods.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Amana Capital stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.