For over a decade, FxScouts has been reviewing forex brokers and providing in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair, with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and Australian markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

- FP Markets - Best ASIC-Regulated Forex Broker

- Pepperstone - Lowest Cost ECN Broker

- AvaTrade - Best Mobile Trading Experience

- markets.com - Best Proprietary Platform

- Axi - Best MT4 Customisation

- IG - Widest Range of Tradable Instruments

- Fusion Markets - Low Costs, 3 Copy Trading Platforms

- XM - Best Education

- FBS - $50 Deposit, Low-Cost Cent Account for Beginners

Best ASIC Regulated Forex Brokers in 2024

Broker | Broker Score | Official Site | ASIC | ASIC License | Min. Deposit | Max. Leverage (Forex) | Beginner Friendly | EUR/USD - Standard Spread | Cost of Trading | EUR/USD - Raw Spread | Total CFDs | Currency Pairs | Platforms | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.40 /5 Read Review | Visit Broker > 79% of retail CFD accounts lose money | Yes | 286354 | AUD 100 | 30:1 | Excellent | 0.00 pips | USD 6 | 0 pips | 10162 | 70 | MT4, MT5, cTrader, IRESS | |

| 4.61 /5 Read Review | Visit Broker > 75.3% of retail CFD accounts lose money | Yes | 414530 | AUD 100 | 30:1 | Excellent | 1.00 pips | USD 10 | 0.10 pips | 1597 | 90 | MT4, MT5, cTrader, TradingView | |

| 4.59 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | Yes | 406684 | AUD 100 | 30:1 | Excellent | 0.90 pips | USD 9 | 0.90 pips | 930 | 63 | MT4, MT5, Avatrade Social, AvaOptions | |

4.68 /5 Read Review | Visit Broker > 70.3% of retail CFD accounts lose money | Yes | 424008 | AUD 100 | 30:1 | Excellent | 0.70 pips | USD 7 | 0.60 pips | 1009 | 56 | MT4, MT5, markets.com | ||

| 4.44 /5 Read Review | Visit Broker > 75.6% of retail CFD accounts lose money | Yes | 318232 | AUD 0 | 30:1 | Excellent | 1.00 pips | USD 10 | 0.00 pips | 188 | 70 | MT4 | |

| 4.69 /5 Read Review | Visit Broker > 69% of retail CFD accounts lose money | Yes | 220440 | AUD 0 | 30:1 | Excellent | 0.60 pips | USD 6 | 0.85 pips | 19295 | 80 | MT4, L2 Dealer, ProRealTime | |

4.41 /5 Read Review | Visit Broker > 89% of retail CFD accounts lose money | Yes | 385620 | AUD 0 | 30:1 | Excellent | 0 pips | USD 4.50 | 0 pips | 247 | 81 | MT4, MT5, cTrader, TradingView | ||

| 4.45 /5 Read Review | Visit Broker > 75.33% of retail CFD accounts lose money | Yes | 443670 | AUD 5 | 30:1 | Excellent | 0.60 pips | USD 6 | 0.60 pips | 1554 | 57 | MT4, MT5 | |

| 4.33 /5 Read Review | Visit Broker > 69.21% of retail CFD accounts lose money | Yes | 426359 | AUD 5 | 30:1 | Excellent | 0.70 pips | USD 7 | 0.70 pips | 573 | 72 | MT4, MT5, FBS App |

How to compare ASIC regulated brokers

ASIC is one of the most respected financial regulatory agencies in the world. While they have a traditional centre, they try to be modern in their approach, researching and making regulatory changes to maintain fairness in the CFD industry. All ASIC-regulated brokers can be considered safe due to the strict regulatory environment in which they operate, and most of them are very strong all-round. But it is essential to look at the detail of each broker to find out what differentiates them from each other. When comparing ASIC regulated brokers consider:

Regulation: While your broker is ASIC regulated, your trading account may not be. It is increasingly common for ASIC regulated brokers to onboard Australian clients onto a different license where trading conditions, like leverage, can be increased without the ASIC oversight. While this is not fundamentally bad, a trader should know their trading account is regulated and that ASIC will not enforce their regulations in overseas territories.

Platform choice: Traders have a wide range of industry platforms to choose from, each with pros and cons. When comparing brokers, always consider the platform options, as unique features or a wide variety of platforms could change your trading experience. MetaTrader 4 is still the industry standard, but many brokers offer MetaTrader 5 and their proprietary platforms. ECN/STP brokers will often support cTrader as it is built specifically for market execution and only allows for minimal broker interference.

Trading costs: Every broker will charge for their services, but each will have different pricing models and costs. While ECN brokers will charge a smaller spread combined with a commission based on volume, market maker brokers will charge a wider spread. We compare brokers by looking at what 1 lot of EURUSD costs to trade and would encourage traders to do the same in comparing costs.

Minimum Deposit: The minimum deposit could change by account type, with higher minimum deposits often linked to better conditions. Always consider the minimum deposit specific to the account type you may open.

Deposit and Withdrawal Methods: Most brokers accept credit cards and bank transfer payments, and many accept online payments through Skrill and Neteller, and some will also accept Bitcoin. Always check the withdrawal fees before making a deposit.

Others Also Visit

FP Markets – Best ASIC-Regulated Forex Broker

FP Markets was founded in Sydney, Australia after receiving an ASIC licence (ASFL: 286354) in 2005. Under the strict ASIC rules, FP Markets is constantly monitored and evaluated on its performance and trade execution. FP Markets also segregates all client funds in the Commonwealth Bank, one of the largest of four banks in Australia. FP Markets has gained recognition for its competitively low trading fees and its broad trading platform support, including IRESS, an advanced trading platform that allows trading on over 10,000 share CFDs.

Low Trading Fees: FP Markets offers competitive trading fees on two live accounts, with spreads averaging at 1 pip (EUR/USD) on its commission-free Standard Account and 0 pips (EUR/USD) on its Raw Account in exchange for a commission of 7 USD. The minimum deposit requirements are 100 AUD on both accounts, making them accessible to all traders.

Trading Platforms: FP Markets’ trading platforms include MT4, MT5, and the IRESS trader, an advanced share trading platform with direct market access. MT4 is the most popular trading platform in the world, while MetaTrader 5 (MT5) has more tools, such as an embedded economic calendar and chat system. In comparison to the MetaTrader platforms, IRESS has a simpler user interface and more functionality, including advanced order types, news alerts, customizable charts, advanced watchlist features, and access to over 10,000 trading instruments.

Pepperstone Lowest Cost ECN Broker

An ASIC regulated broker (ASFL: 414530), Pepperstone was founded in 2010 in Melbourne and has grown to be one of the largest ECN brokers in the world, with over 300,000 clients and 12+ billion-dollar daily trading volume. While the new rules introduced by ASIC in 2021 will harm many of the low-quality brokers in Australia, Pepperstone is well-placed to benefit with its low fees, ultra-fast execution, and three popular trading platforms.

Lowest Trading Fees: Pepperstone offers two accounts with some of the lowest trading fees in the industry – a Razor Account with spreads that average at 0.10 pips (EUR/USD) in exchange for a commission of 7 USD, and a commission-free Standard Account with spreads that starts at 1.00 pips on the EUR/USD. Trades are executed in under 0.3 seconds, which means that orders are filled as close to the quoted price as possible. Additionally, there are no minimum deposit requirements, making both accounts accessible to beginners.

Trading Platforms: Pepperstone’s trading platforms include MetaTrader 4 (MT4), Metatrader 5 (MT5), and cTrader, a broader range of platforms than is typically found at other brokers. MT4 is the most popular trading platform while MetaTrader 5 (MT5) has more tools, such as an embedded economic calendar and chat system. cTrader is a more modern trading platform and is easier for beginners to learn but still has all the sophisticated automation tools found in MT4 and MT5. While trading conditions vary slightly depending on the trader’s preferred platform, trading costs are still lower than those of other similar brokers.

Avatrade – Best Mobile Trading Experience

Founded in 2006 in Dublin, Ireland, Avatrade is an ASIC regulated broker (AFSL: 406684) with over 200,000 registered users and an average monthly trading volume of 60 billion USD. In line with the 2021 ASIC changes, Avatrade amended its product offering, which included reducing its leverage from 400:1 to 30:1 for retail traders. Additionally, Avatrade provides a user-friendly trading environment on a range of trading platforms, including its innovative mobile app – AvaTradeGO. AvaSocial, Avatrade’s social trading platform is also available as a downloadable app.

AvaTradeGO: An award-winning application, AvatradeGO allows traders to connect to global trading markets, create their own watchlists, and view live prices and charts. AvatradeGO also provides free access to analysis tools such as Autochartist, Duplitrade, a copy trading tool, and AvaProtect, its own state-of-the-art risk management system. Avatrade’s trading fees are average compared to other similar brokers, with a minimum deposit requirement of 100 AUD, spreads that start at 0.90 pips pips on the EUR/USD, and no commissions charged on Forex trades.

Avasocial: Avasocial is Avatrade’s social and copy trading platform. Available on both Android and iOS, the mobile app allows traders to replicate the trades of other successful traders. Traders can opt to trade manually or to use a fully automated service. Traders can also interact with other traders and ask questions on specific strategies, find out more about various markets, and seek out a mentor, making it a great tool for beginner traders.

Markets.com – Best Proprietary Platform

Markets.com is a global broker founded in 2010 and regulated by ASIC with AFSL number: 424008. Markets.com offers one live account, with a minimum deposit requirement of 100 AUD and spreads starting as low as 0.6 pips on the EUR/USD. Traders can choose from three trading platforms, including MT4, MT5, as well as markets.com’s own proprietary platform, considered by many to be one of the best in-house trading platforms in the industry.

The intuitive platform includes features such as fundamental, technical, and sentiment analysis tools as well as advanced charting with several indicators, like Forecasting, Long/Short position tracking, Elliott Wave and Gann.

Traders will also find a wide range of financial instruments available, including shares, ETFs, Indices, commodities, Forex, cryptocurrencies, and bonds.

Axi – Best MT4 Customisation

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Axi is an Australian ASIC-regulated ECN broker with full support for the MT4 platform, a range of useful trading tools, and excellent MT4 customisation options. By limiting its platform choice to MT4, it focuses on providing various powerful platform-integrated analysis tools, including Autochartist, MyFxBook, and PsyQuation, which help beginner and more experienced traders make better trading choices.

PsyQuation is one of the world’s most advanced data analytics plugins. Featuring highly sophisticated algorithms, it analyses your trading style and coaches you into more profitable trades. In addition to the powerful trading tools, Axi offers excellent customer support available 24/5 to help with platform set-up and any other technical inquiries.

IG – Widest Range of Tradable Instruments

| 🏦 Min. Deposit | AUD 0 |

| 🛡️ Regulated By | ASIC, MAS, BaFin, BMA |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

Founded in London in 1974, IG has a regional HQ in Melbourne and has been regulated by ASIC since 2002 (ASFL: 220440). The largest broker in the world by revenue and regulated by 17 authorities worldwide, IG is also one of the few brokers that supported ASIC’s introduction of tighter regulations in early 2021. In addition to being one of the best regulated ASIC brokers, IG has the widest range of financial instruments and some of the lowest trading fees in the industry on three trading platforms.

Widest range of financial instruments: IG offers over 17,000 financial instruments, many more than most other brokers. Tradeable CFDs include 13,000 share CFDs, 6000 ETFs, and 80 Forex pairs. IG also offers weekend trading on major Forex pairs and 24 hour trading on Australia’s leading stock index, the ASX 200. Both of these are unique services that are not available at other brokers. IG Market’s single account has low fees compared to other brokers, with no minimum deposit requirements, spreads starting at 0.85 pips on the EUR/USD, and no commission charged on Forex trading.

Trading Platforms: IG’ trading platforms include MetaTrader 4 (MT4) its own web-based platform, and L2 Dealer, a specialist share trading platform that offers direct market access (DMA) to clients who maintain an account balance of 2000 AUD. MT4 and the IG trading platforms are more user-friendly and suited to beginner traders, while the L2 Dealer offers advanced analytical tools and charting packages for more experienced traders.

Fusion Markets – Low Costs, 3 Copy Trading Platforms

Founded in 2017 in Melbourne, Fusion Markets is an ASIC-regulated broker (AFSL 226199) with a range of copy-trading options, exceptionally low trading costs and no minimum deposit requirements. Its Fusion+ copy trading platform is only available in a proprietary trading platform, but it also offers Duplitrade and Myfxbook Autotrade – two of the largest Forex social trading communities in the world.

In terms of traditional trading, Fusion Markets is one of the lowest-cost brokers in the world. EUR/USD spreads start at 0 pips on its Zero Account with a very low commission of 4.50 AUD (round turn), most other brokers offering raw spreads will have a commission of 6 AUD or higher. The only drawbacks are a relatively limited number of CFDs (though 85 Forex pairs is better than most brokers) and very limited education, so beginners will have to educate themselves elsewhere.

XM – Best Education

Founded in 2009 in Cyprus, XM has over 5,000 0000 traders on its books from 192 countries. With a long history of regulatory oversight, XM gained its ASIC licence (AFSL number: 443670) in 2014 and set up a regional office in Melbourne. Under the strict ASIC regime, XM offers an Ultra-Low account with low trading fees and provides some of the best educational support in the industry.

Daily Live Education: XM excels in its educational offering, which includes educational videos, courses, platform tutorials, Forex seminars, and live Q&A sessions available every hour from Monday to Friday. Topics include the basics of Forex trading, technical analysis, trading strategies, fundamental analysis, and major currency fundamentals. XM also offers comprehensive market analysis, providing traders with a daily market overview, frequently updated news, trading ideas, technical summaries, a podcast, and regular research updates.

XM’s Ultra-Low Account: Available on the MT4 and MT5 trading platforms, XM’s Ultra-Low Account has competitive trading fees, with spreads that start at 0.8 pips on the EUR/USD, no commissions for Forex trading, and a minimum deposit of 50 USD. XM also boasts a strict no requotes and no rejections policy, and 99.35% of all trading orders are executed in less than one second, which means that traders will usually receive the trading prices that are quoted.

FBS – $50 Deposit, Low-Cost Cent Account for Beginners

Regulated by ASIC since 2012, FBS is a large global broker with over 17 million customers worldwide. In Australia, FBS offers three trading accounts on the MT4 and MT5 platforms. All three accounts have a low minimum deposit of 1 USD and low trading costs. Beginners will appreciate the Cent Account, with spreads down to 0.6 pips on the EUR/USD and all trading denominated in cents rather than dollars.

Beginners will also like FBS’ well-structured education section, detailed webinars and 24/7 customer support. Weekend customer support is especially important for trading FBS’ range of crypto CFDs, as the crypto market never closes. More experienced traders may be interested in FBS´s Ultra Account, which offers raw spreads, though the round-turn commission is higher than can be found at other brokers.

Is Forex Trading Legal in Australia?

Yes. Forex trading is legal in Australia. Before brokers can legally accept clients resident in Australia, they must attain an Australian financial services (AFS) license from ASIC.

How do I start trading forex in Australia?

Forex trading starts with selecting a Forex broker. A Forex broker is the link between you and the Forex market. While there are many different forex brokers, each has its individual trading costs, educational material, trading conditions and trading platform selection. It is strongly recommended that Australian residents register with ASIC regulated brokers.

Why Trade with an ASIC Regulated Forex Broker?

There are few genuinely strong regulators in the world; the UK’s Financial Conduct Authority is one, the Cyprus Securities and Exchange Commission is another, and most would agree that ASIC is also a member of this group. ASIC has already built a reputation for guaranteeing trader security and dealing harshly with bad brokers, but in March 2021 ASIC deployed an even stricter regulatory environment. We will talk about what that environment looks like in more detail below, but first, let’s look at the current benefits of trading with an ASIC-regulated broker.

- Segregated Accounts: Like most good regulators, ASIC ensures that all brokers keep client funds segregated from broker operational funds and in Tier 1 Australian banks.

- Negative Balance Protection: ASIC requires all brokers to provide protection against negative balance by limiting a retail client’s CFD losses to the funds in their CFD trading account.

- Dispute Resolution and Customer Satisfaction: The Australian Financial Complaints Authority (AFCA) handles all disputes between traders and brokers and are known for efficiency and fairness. Importantly, brokers are responsible for the cost of the resolution and not the trader – this provides an incentive for brokers to respond quickly and fairly to all customer complaints. Unsurprisingly, ASIC Forex brokers are consistently rated very highly for customer satisfaction.

- No Conflict of Interest: ASIC has banned all Forex brokers from being a counterparty to their client’s trades, furthermore all brokers are required to offer a fast and efficient platform with no broker interference. It is perhaps as a result of these restrictions that Australia hosts many of the world’s best ECN brokers.

List of ASIC-Regulated Brokers

This is our list of all ASIC-regulated brokers that we have reviewed, ordered by their overall score. The broker that scores highest overall is at the top of the list.

Broker | Broker Score | ASIC License | Regulators | Min. Deposit | Beginner Friendly | Cost of Trading | Trading Platforms | Total # CFDs | No. of FX Pairs | Trading Commission | Compare | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.69 /5 Read Review | 220440 |     | AUD 0 | 30:1 | Excellent | USD 6 | MT4, L2 Dealer, ProRealTime | 19295 | 80 | Fees Included in Spread | |

4.68 /5 Read Review | 424008 |     | AUD 100 | 30:1 | Excellent | USD 7 | MT4, MT5, markets.com | 1009 | 56 | Fees Included in Spread | ||

| 4.61 /5 Read Review | 414530 |     | AUD 100 | 30:1 | Excellent | USD 10 | MT4, MT5, cTrader, TradingView | 1597 | 90 | 6 USD / lot | |

| 4.59 /5 Read Review | 406684 |     | AUD 100 | 30:1 | Excellent | USD 9 | MT4, MT5, Avatrade Social, AvaOptions | 930 | 63 | Fees Included in Spread | |

4.53 /5 Read Review | 391441 |     | AUD 100 | 30:1 | Excellent | USD 10 | MT4, MT5, TradingView | 846 | 55 | 7 USD / lot | ||

| 4.45 /5 Read Review | 443670 |     | AUD 5 | 30:1 | Excellent | USD 6 | MT4, MT5 | 1554 | 57 | Fees Included in Spread | |

| 4.44 /5 Read Review | 318232 |     | AUD 0 | 30:1 | Excellent | USD 10 | MT4 | 188 | 70 | 7 USD / lot - PRO account | |

4.43 /5 Read Review | 424700 |     | AUD 0 | 30:1 | Excellent | USD 11 | MT4, MT5, ThinkTrader | 4150 | 46 | 7 USD / lot - ThinkZero Account | ||

4.41 /5 Read Review | 385620 |   | AUD 0 | 30:1 | Excellent | USD 4.50 | MT4, MT5, cTrader, TradingView | 247 | 81 | 4.5 AUD / lot (EUR/USD) | ||

| 4.40 /5 Read Review | 286354 |     | AUD 100 | 30:1 | Excellent | USD 6 | MT4, MT5, cTrader, IRESS | 10162 | 70 | 6 USD / lot - RAW Accounts | |

4.38 /5 Read Review | 345646 |     | AUD 0 | 30:1 | Excellent | USD 5 | MT4 | 4874 | 84 | Fees Included in Spread | ||

| 4.38 /5 Read Review | 286354 |     | AUD 50 | 30:1 | Excellent | USD 6 | MT4, TradeStation | 3556 | 43 | None | |

| 4.33 /5 Read Review | 426359 |    | AUD 5 | 30:1 | Excellent | USD 7 | MT4, MT5, FBS App | 573 | 72 | Fees Included in Spread | |

4.33 /5 Read Review |     | USD 100 | 500:1 | Standard | USD 12 | MT4, MT5 | 2006 | 130 | Fees Included in Spread | |||

4.33 /5 Read Review | 416279 |     | AUD 50 | 30:1 | Excellent | USD 15 | MT4, MT5, cTrader | 20108 | 50 | 3 USD / lot | ||

4.28 /5 Read Review | 410681 |     | AUD 100 | 30:1 | Excellent | USD 8 | MT4, MT5, MT Supreme | 3996 | 82 | 1.8 - 3 USD per lot | ||

4.28 /5 Read Review | 493520 |    | AUD 100 | 30:1 | Excellent | USD 20 | MT4 | 415 | 50 | Fees Included in Spread | ||

4.25 /5 Read Review | 412981 |     | USD 0 | 30:1 | Excellent | USD 10 | MT4, MT5 | 425 | 45 | 4 USD / lot | ||

4.08 /5 Read Review | 403863 |   | AUD 50 | 30:1 | Standard | USD 10 | MT4, MT5 | 2489 | 63 | Fees Included in Spread | ||

4.05 /5 Read Review | 422661 |     | AUD 5 | 30:1 | Standard | USD 6 | MT4, Cloud Trade | 1202 | 36 | Fees Included in Spread | ||

| 4.02 /5 Read Review | 246566 |     | AUD 200 | 30:1 | Standard | USD 18 | MT4, MT5 | 193 | 63 | Fees Included in Spread | |

| 3.80 /5 Read Review | 439907 |     | AUD 500 | 30:1 | Standard | USD 40 | MT5, Sirix | 602 | 48 | Fees Included in Spread |

Is Forex trading tax-free in Australia?

Forex gains are not tax-free income, and all profits are taxable, even if your brokerage and capital are overseas. Australians are expected to declare taxes just as with any other income – regardless of if you are trading as an individual or a company.

Changes in ASIC Regulation

Big changes in ASIC regulation have been coming for some time. In ASIC’s 2019 review of the Australian OTC retail derivative market, it found a considerable increase in the number of traders since 2017 and an equally large increase in turnover at ASIC regulated brokers.

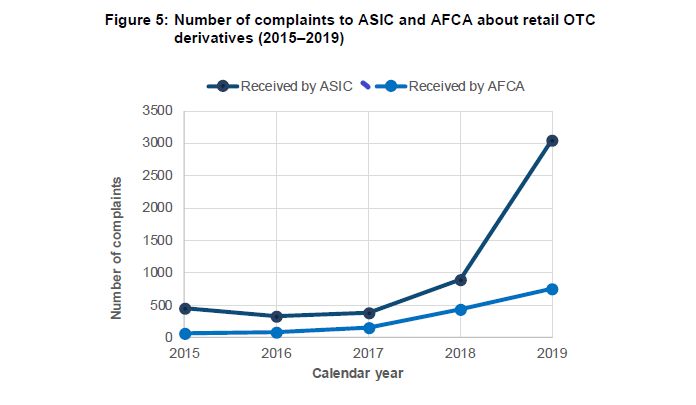

ASIC also published the data on complaints filed against CFD brokers over the same period, and the results were shocking.

From 2017-19 complaints received by ASIC had increased by 600%, a situation that ASIC has concluded is not sustainable in a sector where the majority of customers are known to lose money.

- over 1.1 million CFD positions were terminated under margin close-out arrangements (compared with 9.3 million over the full year of 2018)

- more than 15,000 retail client CFD trading accounts fell into negative balance, owing to a total of $10.9 million (compared with 41,000 accounts owing $33 million over the full year of 2018).

As a response to these damning sets of data, and citing the 2018 tightening of regulation in Europe by ESMA, ASIC issued a product intervention order for all ASIC-regulated CFD brokers. This product intervention order went into force on 29th March 2021 and includes:

- A complete ban on binary options

- Varying leverage restrictions for all CFDs: 30:1 for forex and gold, 15:1 for stock indices, 10:1 for commodities (excluding gold), 2:1 for cryptocurrencies and 5:1 for equities and all other instruments.

- A forced stop-out at 50% of the total initial margin of all open trades

- Mandatory negative balance protection

- A complete ban on all bonus schemes, promotions and other incentives to traders.

- All broker trading platforms must always display total position size and overnight funding costs related to open positions in real-time.

- ASIC also stated that they expect all brokers to publish their pricing methods

As these new restrictions went into force ASIC Commissioner Cathie Armour said:

‘We will closely monitor compliance with the product intervention order and won’t hesitate to take appropriate action to enforce the order. We are also paying careful attention to changes in CFD providers’ reported holdings of retail client money and any misclassification of retail clients as wholesale clients, which would risk denying them important rights and protections. Protecting retail investors from harm, particularly at a time of heightened vulnerability, is a priority for ASIC,’

ASIC has also warned Australian brokers away from working with offshore investors illegally, especially as regulators in China, Japan and Europe and North America have placed restrictions or bans on CFDs for retail investors. ASIC has also started working more closely with CFD brokers to ensure compliance with foreign laws and is actively engaged with multiple international regulatory bodies in this matter.

If you want to know more about how these changes might affect your trading, we recommend getting in touch with ASIC or your broker to discuss the options available to you.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the Australian regulator, ASIC or the UK’s regulator, the FCA).

Our Rating & Review Methodology

Our overall Forex Rankings report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Others Also Visit

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.