-

MetaTrader 4 Brokers

The top MT4 brokers in AU

-

MetaTrader 5 Brokers

The best MT5 brokers in AU

-

TradingView Brokers

The best TradingView brokers

-

cTrader Brokers

The top cTrader brokers in AU

-

Forex Trading Apps

Trade on the go from your phone

-

Copytrading Brokers

Copy professional traders

-

All Trading Platforms

Find a platform that works for you

IFC Markets Broker Review

Last Updated On May 12, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website you agree to our Terms of Service.

Our verdict on IFC Markets

IFC Markets caters well to beginner traders with four low-cost Micro accounts, a well-structured education section, and support for its proprietary platform, which is easier to use and set up than other third-party platforms. IFC Markets also stands out for its innovative Portfolio Quoting Method, which allows for the creation of personalized trading instruments.

IFC Markets offers a low-cost trading environment for traders willing to try its proprietary NetTradeX platform. Support is also provided for the Metatrader platforms, but trading costs remain uncompetitive. However, clients can choose to trade on over 600 financial assets, including synthetic CFDs, and even create their instruments.

It is clear that IFC Markets focuses on providing a welcoming environment for new traders, with minimum deposits of 5 USD on its beginner-friendly Micro accounts and a host of learning materials covering trading basics.

Alongside the high trading fees on the Metatrader platforms, IFC Markets’ non-trading fees are high, including charges for deposits and withdrawals. In addition, it has a limited number of base currencies, which means that Australian traders will have to pay currency conversion fees.

| 🏦 Min. Deposit | USD 5 |

| 🛡️ Regulated By | CySEC, B.V.I FSC, LFSA |

| 💵 Trading Cost | USD 5 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Great platform choice

- Wide range of assets

- Low minimum deposit

Cons

- Slow withdrawals

- Poorly regulated

Is it Safe?

Yes, IFC Markets is a safe broker for Australian traders to trade with. It has good regulatory oversight, segregates client funds, and provides traders with negative balance protection.

Founded in 2006, the IFC markets group is based in the British Virgin Islands and consists of three brokerage firms and a FinTech company. It maintains regulation from the British Virgin Islands Financial Services Commission (BVI FSC), Labuan Offshore Financial Services Authority, and the Cyprus Securities and Exchange Commission (CySEC).

Although clients from Australia will be trading through the British Islands-based subsidiary which has less regulatory supervision than IFC Markets’ company based in Cyprus, it segregates its client funds from company funds and provides all traders with negative balance protection. On this basis, we consider IFC Markets a safe broker for Australian clients to trade with. Click here for more details on IFC Markets’ regulatory oversight.

Trading Fees

IFC Markets trading fees are average compared to other brokers.

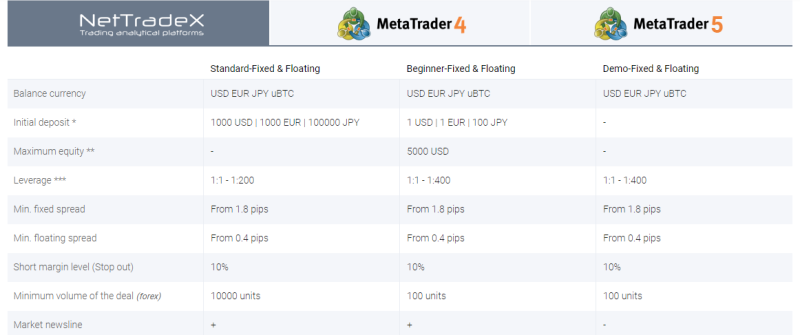

IFC Markets’ offers a wider range of accounts than other brokers, some with floating spreads and others with fixed spreads on the MT4, MT5, and NetTradex platforms. Trading costs vary depending on the account type chosen by the trader and all accounts are commission-free (click here for more on IFC Markets’ accounts).

All fixed spread accounts have a spread of 1.8 pips on the EUR/USD, which is wider than the spreads on other brokers’ accounts, however, the spreads on the floating accounts start at 0.50 pips on the EUR/USD, which represents a competitive offer.

IFC Markets’ accounts were assessed to compare the costs to those of other brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spread and commission:

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table above, the trading fees on the floating spread accounts are significantly lower than those of the fixed spread accounts. However, traders should be aware that on the floating accounts, spreads will get wider or tighter depending on trade volume and market volatility.

There is also a vast difference between the minimum deposits on the Micro accounts and Standard accounts, which start at 5 USD and 1000 USD, respectively.

The average cost of trading one lot of EUR/USD at similar Forex brokers tends to be 9 USD or lower. Compared to other brokers, IFC Markets’ trading fees are higher than average on its fixed spread accounts and lower than average on its floating spread accounts.

Swap Fees

In a welcome show of transparency, IFC Markets publishes all swap fees for each instrument on its site. Swap fees are derived from the current bank interest rates plus a small mark-up charged by IFC Markets. In the case of Forex instruments, the amount charged depends on both the positions taken (i.e. long or short) and the rate differentials between the two currencies traded.

For example, the current long swap rate for one lot of EUR/USD is -0.51 USD, and -0.07 USD for a short position.

IFC Markets’ Non-trading Fees

IFC Markets’ non-trading fees are average compared to other similar brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

IFC Markets charges fees for both deposits and withdrawals on most payment methods. For example, a fee of 2% + 7,5 USD (or equivalent) per transaction is charged for withdrawals via debit card or credit card. For more on IFC Markets’ deposit and withdrawal methods and fees, click here.

However, unlike most other brokers, IFC Markets does not charge inactivity fees on dormant accounts, but accounts will be archived after only one month of inactivity.

Overall, IFC Markets’ non-trading fees are average compared to other market maker brokers, with high withdrawal and deposit fees on some methods, but no inactivity fees.

Opening an Account at IFC Markets

The account opening process at IFC Markets is fully digital, fast, and hassle-free compared to other brokers.

Creating an account at IFC Markets is straightforward. The process is fully digital, and accounts are usually ready within one day. IFC Markets offers corporate and individual accounts, but we will focus on opening an individual account:

How to open an account at IFC Markets:

-

New traders will have to click on the “Open Account” button at the top of the page where they will be directed to register an account.

-

IFC Markets’ intake form requires clients to fill in their personal details, (including name, country of residence, email, and telephone number).

-

Next clients must choose to open either a demo or live account and select their account preferences, including trading platform (MT4, MT5, or NetTradex), account type, level of leverage, and base currency.

-

Traders will then have to read and accept IFC Markets’ legal documents (including customer agreement, terms of business, and risk disclosure).

-

Traders can then deposit funds into their accounts (click here for more on IFC Markets’ deposit and withdrawal methods).

-

IFC Markets needs at least two documents to accept you as an individual client:

-

Proof of Identification – IFC Markets accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID. The document must be valid and must contain a trader’s full name, date of birth, a clear photograph, issue date, and if it has to have an expiry date, that should be visible as well.

-

Proof of Address – Proof of residence/address document must be issued in the name of the IFC Markets’ account holder within the last 3 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

-

Overall, IFC Markets’ account-opening process is quick, efficient, and accounts are generally ready for trading within one business day.

Trading Accounts

IFC Markets offers more account types than most other brokers, and its accounts are suitable for beginners and more experienced traders.

IFC Markets has eight different commission-free account types suited to both beginner and experienced traders alike. Beginner traders are inexperienced traders who have never traded before, or who have been trading for less than a year. Beginner traders often do not want to risk trading large sums of money and generally will not be able to trade full-time during the workweek.

Accounts with lower minimum deposits and which allow trading in micro-lots are generally more suited to beginner traders. IFC Markets offers four beginner-friendly accounts, which all allow micro-lot trading and have a minimum deposit of 5 USD.

Experienced traders tend to prefer accounts with higher minimum deposits and tighter spreads. IFC Markets’ Standard accounts all have a minimum deposit of 1000 USD and traders can choose between fixed-spread (of 1.8 pips on the EUR/USD) and floating spread accounts (which start at 0.50 pips pips on the EUR/USD). However, traders should note that they can only access the lower-cost floating spread accounts on the MT5 and NetTradeX platforms, making MT4 an unappealing option.

Leverage also varies depending on the account type. Traders can access leverage of up to 400:1 on the Micro accounts, while the maximum leverage on the standard accounts is up to 200:1. Hedging and scalping are unlocked on all accounts, while netting is only available on the MT5 and NetTradeX platforms. See below for more details:

- Metatrader 4 Accounts: There are two different MT4 accounts – the MT4 Micro Account (with a minimum deposit of 5 USD) and the MT4 Standard Account (with a minimum deposit of 1000 USD). Both accounts are fixed spread accounts, with a spread of 1.8 pips on the EUR/USD, which is significantly wider than other brokers, making the MT4 accounts less attractive than the MT5 and NetTradeX accounts.

- MetaTrader 5 Accounts: IFC Markets offers two MT5 accounts, which, unlike the MT4 accounts, are both floating spread accounts with a minimum spread of 0.50 pips on the EUR/USD, which is significantly tighter than other brokers. Like the MT4 accounts, the minimum deposit is 5 USD on the MT5 Micro account and 1000 USD on the MT5 Standard Account.

- NetTradeX Accounts: IFC Markets offers four NetTradeX Accounts – two fixed spread accounts (a beginner-friendly and standard account) with a spread of 1.8 pips on the EUR/USD, and two floating spread accounts (again, a beginner-friendly account and a standard account) with spreads of 0.50 pips on the EUR/USD. The beginner-friendly accounts have a minimum deposit of 5 USD and the Standard accounts have a minimum deposit requirement of 1000 USD.

- Demo Accounts: IFC Markets’ free demo account mimics the conditions found on both the floating and fixed spread accounts. The demo account is available with a virtual USD balance that can be topped up on request. Demo accounts do not expire and are available on the MT4, MT5, and NetTradeX platforms.

Overall, IFC Markets’ trading costs are higher than other similar brokers on its fixed spread accounts and lower than average on its floating spread accounts. Additionally, the Micro Account is an excellent account for beginner traders; its spreads are tighter, and its starting costs are lower than the entry-level accounts at other brokers.

IFC Markets’ Deposits and Withdrawals

IFC Markets offers a wider range of funding methods than other similar brokers but charges relatively high fees on most deposit and withdrawal methods.

An FSA-regulated broker, IFC Markets ensures that all Anti-Money Laundering rules and regulations are followed. As such, all non-profit funds are returned to the original deposit source.

Deposits and withdrawals are processed during back-office hours – Monday to Friday 07:00 AM to 07:00 PM (CET). See below for more details:

-

Bank Transfer – IFC Markets does not charge a commission for bank wire transfers, but traders should be aware that a fee of 30 USD/EUR or 3000 JPY may apply for deposits and 25 USD/EUR or 2500 JPY may apply for withdrawals. Both deposits and withdrawals take 2 – 3 days to be processed.

-

Visa/Mastercard – A minimum deposit of 100 USD is required and will reflect to your trading account immediately. There are no fees for this deposit method, but a fee of 2% + $7,5 / 2% + €6 / ¥1500 applies for withdrawals and it takes 1 – 5 days for the payment to be processed.

-

Alternative Payment Systems – IFC Markets allows deposits from several alternative payment systems. These include PerfectMoney, Cashu, WebMoney, cryptocurrencies, and BitPay. All of these deposit and withdrawal methods will reflect in your trading account within minutes to 24 hours and fees are charged for most transactions.

Please see below for details:

Overall, IFC Markets provides a wide range of funding methods, and while its processing times are reasonable, fees apply to most deposit and withdrawal methods.

Base Currencies (Trading Account Currencies)

IFC Markets has a very limited number of base currencies compared to other brokers.

At IFC Markets, you can only choose from three base currencies: USD, EUR, and JPY. This is extremely limited compared to most other international brokers operating in Australia.

Because IFC Markets does not support accounts denominated in AUD, traders from Australia will have to pay conversion fees on all deposits and withdrawals. Conversion fees can make trading expensive, and affect profitability.

In this case, it is better for traders that trade in large volumes (more than 10 lots a month) to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with another currency account, there will be a small conversion fee for every trade made.

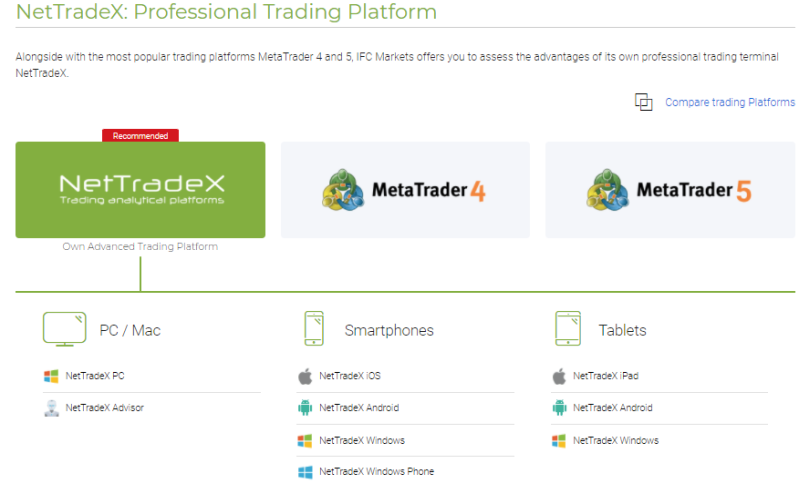

Trading Platforms

IFC Markets platform support is excellent compared to other similar brokers.

Clients can choose between the MetaTrader 4 (MT4), MetaTrader 5 (MT5), and NetTradeX or use all three platforms at the same time. All platforms offer fast trading and advanced charting tools, expert advisors, customisable charting, and indicators.

The platforms are free to use and can be downloaded to your PC and all have web versions of the platform. They are also available on mobile Android and iOS devices.

Third-party platforms such as MT4 and MT5 are less user-friendly and more difficult to set up than the NetTradeX platform. However, traders can take their customised versions of these platforms with them should they choose to migrate to another broker.

NetTradeX

The NetTradeX platform is available in 17 languages and is very similar to the MT4/MT5 platform, including the custom programming language (NTL+) to develop automated trading solutions. One difference is the use of synthetic assets created by traders (see below for more details on the Portfolio Quoting Method). Along with trading on a wide set of instruments, setting orders, and conducting technical analysis, you can also work with additional order types, create your own trading instruments (a feature unique to the NetTradeX platform), and many more. See below for more details:

- Displaying multiple instruments on the same chart

- Technical analysis tools

- Live news feed directly from Thomson Reuters

- Netting trading mode

- Linked Orders

- Pending Orders

- Personal Composite Instruments

Metatrader 4

MetaTrader 4 (MT4) is still undoubtedly the world’s most popular trading platform for forex traders due to its ease of use, feature-rich environment, and automated trading ability. Features of IFC Markets’ MT4 platform include:

- 50+ preinstalled technical indicators

- 24 analytical charting tools

- Three chart types

- Nine timeframes

- One-click trading.

- Traders can also add custom EAs and indicators.

While MT4 has great customizability, the platform feels outdated, and some of the features may be hard to find. In addition, only the basic orders are available, including Market, Limit, Stop, and Trailing Stop.

MetaTrader 5

The newer version of the MetaTrader platform suite, MT5 is being adopted by more traders all the time. MT5 incorporates all of the key features of MT4 and an optimised environment for EA trading.

Features of IFC Markets MT5 platform include:

- 38+ preinstalled technical indicators

- 44 analytical charting tools

- Three chart types

- 21 timeframes

- Additional pending order types

- Detachable charts

- Depth of Market

- An integrated Economic Calendar

Overall, IFC Markets’ trading platform support is one of the best in the industry – it offers enough choice to keep most traders satisfied.

IFC Markets’ Mobile Trading Platforms

IFC Markets’ mobile trading platforms are better than other similar brokers.

All three of IFC Markets’ trading platforms are available on both Android and iOS mobile devices and tablets. Beginner traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced timeframes and fewer charting options.

However, the trading platforms are generally user-friendly and well-designed. The MT4 and MT5 mobile apps allow traders to close and modify existing orders, calculate profit and loss in real-time and allow tick chart trading.

The NetTradeX mobile app offers the best features available on the desktop version including the complete range of order types, trade analysis, and expert advisors.

Overall, IFC Markets’ mobile apps are user-friendly and well-designed and offer most of the features available on the desktop versions.

Trading Tools

IFC Markets’ trading tools are innovative, and it offers an average range of trading tools compared to other similar brokers.

IFC Markets offers a number of trading calculators and its innovative Portfolio Quoting Method. It also offers Autochartist for free, one of the best analysis tools on the market.

Trading Calculators

IFC Markets offers a number of trading calculators, including a Profit/Loss Calculator, a Margin Calculator, and a Currency Convertor.

Portfolio Quoting Method

One of IFC markets’ unique selling points is its innovative Portfolio Quoting Method, but this is only available on its proprietary platform. It allows traders to create unique synthetic assets, including equity versus equity quotations. It also allows traders to study the financial markets and analyse their dynamics. The creation of personalised trading instruments is an emerging trend that will likely become a core service provided by most brokers in the near future.

Autochartist

Autochartist is an automated analysis tool offered through IC Markets’ partnership programme, so there is an additional cost for using the service. Traders will have to contact customer support for more details regarding these costs.

One of the best technical analysis tools on the markets, Autochartist monitors 250+ CFDs 24 hours a day and automatically alerts traders on key trading opportunities and forming trends with the highest probability of hitting the forecast price. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

Overall, although IFC Markets trading tools are average compared to other brokers, its unique Portfolio Quoting Method is an attractive feature.

Financial Instruments

IFC Markets offers a broad selection of tradable assets compared to its competitors.

IFC Markets offers trading on Forex, indices, equities, commodities, cryptocurrencies, synthetic instruments, and ETFs. See below for more details:

-

Forex pairs: IFC Markets offers 49 Forex pairs to trade, including majors, minors, and exotics. This is around the average offered by its closest competitors. Trading is available on MT4, MT5, and NetTradeX.

-

Commodities: IFC Markets offers trading on 26 commodities, including precious metals, energies, and agriculture, which is around the average offered by most other brokers. Trading is available on all IFC Markets’ platforms.

-

Stock CFDs: IFC Markets’ stock CFD offering is broad compared to most of its competitors, with 400 stock CFDs available to trade from 7 global exchanges. Stock CFD trading is available on all IFC Markets’ platforms.

-

Indices: IFC Markets offers cash and futures contracts on over 14 international indices, including the NASDAQ, S&P500, DAX Index, and the Nikkei. This is an average range of index CFDs compared to other brokers.

-

ETFs: IFC Markets offers trading on 4 ETFs, which is a limited range compared to most other brokers.

-

Synthetic Instruments: An innovative and unique offering, IFC Markets has created a portfolio of over 40 ready-made synthetic instruments for trading. All instruments have a fixed spread, which is higher than on other assets, but these are a good choice for traders seeking to diversify their overall portfolio.

-

Cryptocurrencies: IFC Markets only offers trading on two cryptocurrencies, including Bitcoin and Ethereum. Spreads on these currencies are variable and are significantly higher than Fiat currencies but in line with other brokers.

Overall, IFC Markets provides a broad range of tradable assets, which should leave most professional traders satisfied.

IFC Markets’ Research and Market Analysis

IFC Markets has a competent in-house research team and has partnered with several third-party analysis companies to provide more useful market analysis than is available at most other brokers.

IFC Markets’ research and market analysis is divided into a number of sections, each of which provides a specialised benefit for traders looking for market insight and trading opportunities:

- Market data: IFC Markets provides live rates on all its available markets, including currencies, metals, indices, commodities, cryptocurrencies, stock CFDs, and ETFs. Market data includes detailed information on the live price, daily change, and various charts. This is a great tool to get a broad overview of the live rates on various instruments.

- Weekly Market Overview (Videos): IFC Markets provides a weekly video of the major world events with estimates of their influence on financial markets. These videos are produced in-house and are presented by expert analyst, Ahura Chalki.

- Market Movers: A unique and powerful analytical tool, Market Movers is able to instantaneously calculate top market movers. It provides 10 different trading instruments that showed the highest increase (Top Gainers) and the biggest decrease (Top Losers) for a selected period of time (from 1 day to 1 year). Overall, this is an excellent resource.

- Technical Analysis: IFC Markets’ technical analysis is available in written format, curated by in-house analysts. It is detailed and regularly updated, and provides excellent insight.

- Market Overview: Similar to the weekly market overview, but in written format, the market overview provides a daily look at the various market movements on all assets. It is detailed, accurate and regularly updated.

- Trading Ideas: IFC Markets provides a technical analysis overview of the various instruments and highlights their likely trends. These trading ideas are provided by Autochartist.

Between the analytical tools and the sheer scale of market research on offer – in both text, and video format – from in-house and third-party experts, IFC Markets’ market analysis is more useful than most other brokers – though is about equal when compared with other international brokers with large research and analysis budgets.

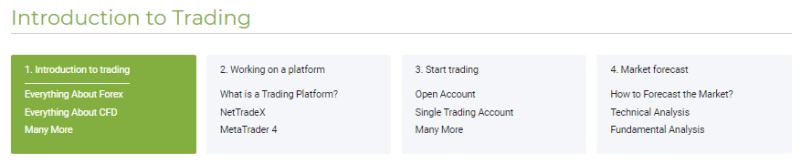

IFC Markets’ Education

IFC Markets’ educational materials are average compared to most other brokers. The materials are well-structured and comprehensive but cater more to beginners than experienced traders.

IFC Markets offers a good selection of learning materials aimed at the beginner trader. These include:

- Articles and videos: Articles and videos that introduce traders to the basics of Forex trading, how to choose a trading platform, how to open a trading account, how to start trading, trading strategies, technical analysis, and fundamental analysis.

- e-books: IFC Markets also provides new traders a series of e-books written in-house that cover the Forex basics and different aspects of online trading. The e-books are detailed and comprehensive.

- Blog: IFC Markets’ blog covers a wide range of topics, from analysis and education to indicators, trading strategies, and market outlook. Articles are published on a daily basis and are brief, but well-structured.

- Trading Glossary: IFC Markets provides a functional glossary of terms to help traders understand the complex terminology of Forex and CFD trading. The most commonly used trading terms, acronyms, and abbreviations are presented, explaining the core ideas and methods used by traders every day.

Overall, IFC Markets’ education section is well-structured and detailed but caters more to beginners than experienced traders.

IFC Markets’ Customer Support

IFC Markets’ customer support is average compared to most other brokers

Support is available during business hours (Mon – Fri, 7:00 – 19:00 CET) in over 19 languages, via email, live chat, various messenger services, telephone, and call-back services. Toll-free local phone numbers and local email addresses give clients direct free access to quality customer service.

For the purposes of this review, we found the live chat agents polite and knowledgeable. They were able to answer most of our questions without hesitation and provided extra reading material where relevant.

Regulation and Safety

IFC Markets is a safe broker for Australian traders to trade with. It maintains regulation from the FSC of the British Virgin Islands, CySEC of Cyrpus, and the Labuan Financial Services Authority of Malaysia.

Established in 2006 and headquartered in the British Virgin Islands, IFC Markets has become a multinational financial broker with over 165,000 traders on its books. IFC Markets is regulated by multiple regulators, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Commission of British Virgin Islands (BVI FSC), and the Labuan Financial Services Authority of Malaysia. See below for more details:

- IFCMARKETS. CORP. is incorporated in the British Virgin Islands under registration number 669838 and is licensed by the British Virgin Islands Financial Services Commission (BVI FSC) to carry out investment business, Certificate No. SIBA/L/14/1073

- IFC Markets Ltd is registered under No. LL16237 in the Federal Territory of Labuan (Malaysia) and is licensed by the Labuan Financial Services Authority (license number MB / 20/0049).

- IFCM Cyprus Limited is licenced by the Cyprus Securities and Exchange Commission, under licence number 147/11.

Australian traders will be trading under the IFC Markets subsidiary authorised and regulated by the Financial Services Commission of the British Virgin Islands (BVI FSC).

The FSC regulatory requirements are not as strict as regulators from the EU or Australia. It does, however, require that all trading brokers hold client funds in segregated accounts and submit periodic reports of their finances and operations. Brokers must also be audited yearly by a trusted third-party auditing company.

Additionally, IFC Markets offers its traders negative balance protection, which means that traders cannot lose more than their initial deposit.

Awards

IFC Markets has won many awards, further burnishing its credentials as a safe broker. Some recent awards include:

- Best International Forex Broker in South Korea 2021 (International Business Magazine)

- Most Customer-Centric Forex Broker – Indonesia 2021 (The Global Economics)

- Best CFD Trading Conditions Southeast Asia 2021 (World Economic Magazine)

- Most Reliable Forex Broker SEA 2021 (World Business)

Overall, because of its long history of responsible behaviour, strong international regulation, and wide industry acclaim, we consider IFC Markets a safe broker to trade with.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the IFC Markets offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

IFC Markets Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. IFC Markets would like you to know that: As with any high-risk financial product, you should not risk any funds that you cannot afford to lose, such as your retirement savings, medical and other emergency funds, funds set aside for purposes such as education or homeownership, proceeds from student loans or mortgages, or funds required to meet your living expenses.

Overview

An STP broker offering multi-asset trading, IFC Markets is a good broker for beginner traders with four relatively low-cost Micro Accounts and support for its own proprietary platform, which is easier for beginner traders to set up and use. Trading costs are higher than average on its fixed spread accounts, but significantly lower than average on its variable spread accounts – down to 0.4 pips on the EUR/USD. Additionally, IFC Markets’ educational and market analysis materials are comprehensive and well-structured and provide a good overview of the basics of trading.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how IFC Markets stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.